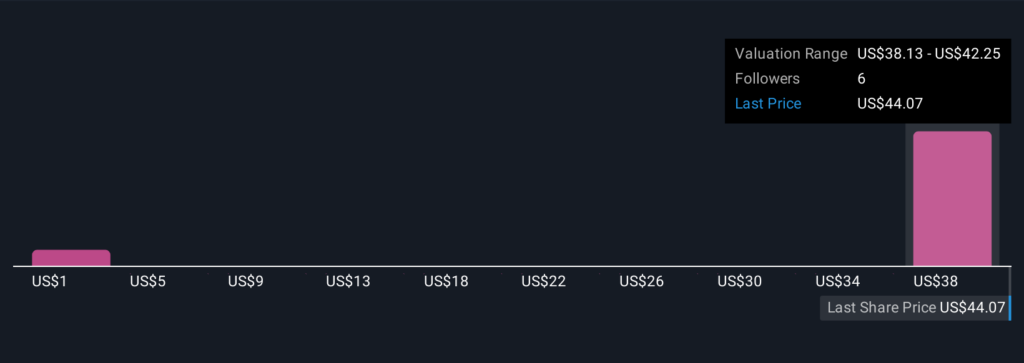

Forge Global Holdings has seen its narrative reset as analysts lift price targets toward the $45 per share cash offer, even while the long term fair value estimate holds steady at $50. A slightly higher discount rate and essentially unchanged revenue growth outlook underscore a cautious but constructive recalibration. This reflects both deal driven upside and completion risk. Stay tuned to learn how you can track these shifting targets and stay ahead of the evolving story around Forge…Read More