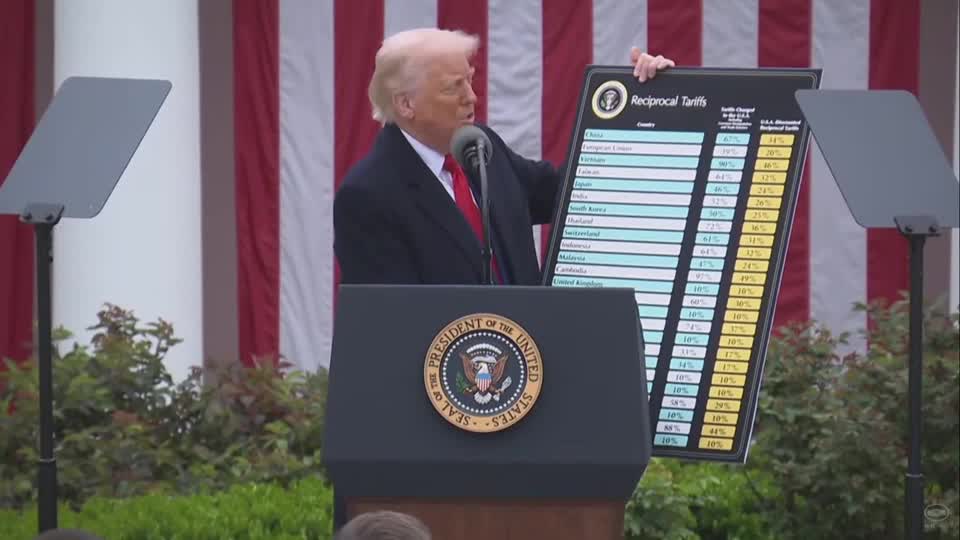

STORY: From the market turmoil over Trump’s tariffs to Chinese inflation data, these are the stories to watch in business and finance in the coming week.:: Lookahead:: Trump’s tariffs:: April 2, 2025U.S. President Donald Trump’s hefty tariffs on major trading partners has plunged markets into turmoil. That’s panicked investors who are now looking for safe havens amid fears a U.S. recession could happen. Global markets have felt the impact of Trump’s “Liberation Day” and are now bracing for retaliation. For market watchers, it’s pretty straightforward – the stronger the retaliation to U.S. tariffs, the higher the chances the world economy lurches into recession and keeps investors away from risk assets.:: ‘Factory Asia’ takes a hit‘Factory Asia’ has taken a particularly large hit from Trump’s tariffs.Six of the nine Southeast Asian countries on Trump’s list face tariffs over 30%.Investors expect Asia’s central banks to counter the hit.But it’s trickier for Sri Lanka. The U.S. typically takes around 40% of its apparel exports, which brought in a net $1.9 billion last year – its second-biggest source of foreign currency.:: Earnings on deckA crucial quarterly reporting season for U.S. companies kicks off in the coming week, led by results from several major banks.JPMorgan, Wells Fargo and Morgan Stanley are among those reporting on April 11.Delta Air Lines and Corona beer maker Constellation brands also post results.Focus will also be on the consumer price index report for March, due April 10. :: Some relief?Chinese inflation data is due on Thursday.The figures come on the heels of China’s State Council’s “special action plan” reveal last month.While recent economic data in the country has turned more favorable and Chinese stocks continue to find more buyers, persistent deflationary pressures remain a huge drag.Trump’s tariffs are also complicating matters.Read More