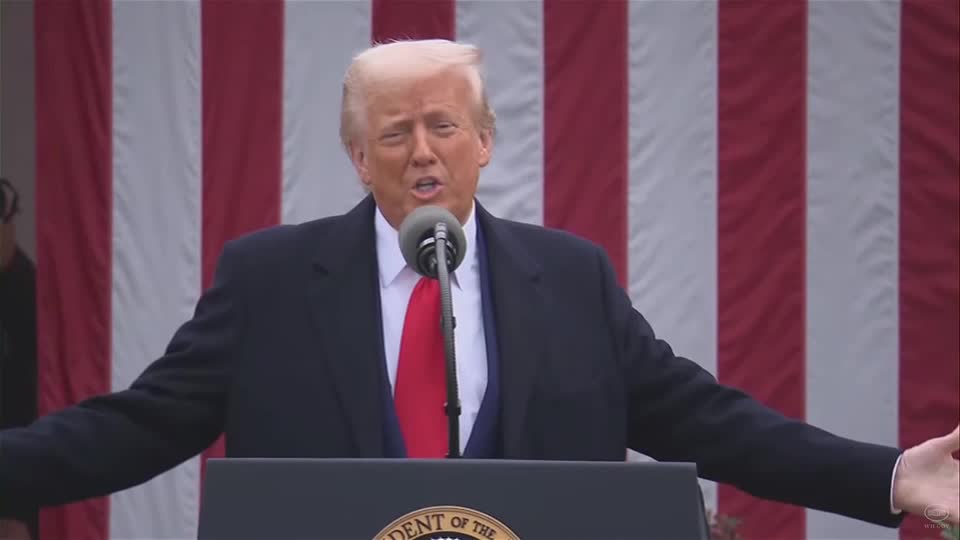

STORY: Global stocks tumbled Thursday as markets digested Donald Trump’s big reveal on tariffs. A day earlier the U.S. president set out sweeping new levies that exceeded most expectations. “My fellow Americans, this is Liberation Day. Been waiting for a long time.”Trump set a minimum 10% tariff on most imports, with much higher rates on some goods and countries. The move sparked an immediate selloff, with Nasdaq futures falling 4%. Some $760 billion was wiped off the value of the so-called ‘Magnificent Seven’ big tech stocks in U.S. after-hours trade. Among them: Apple, which makes iPhones in China, down nearly 7%.The slide then rolled on in Asian trade Thursday. In Japan – hit with a 24% tariff – the Nikkei index was down around 3% by mid-morning. Hong Kong’s Hang Seng fared slightly better, down around 1.5%, with techs also hit hard there. Computer maker Lenovo was off about 5% early on. Markets have been roiled for weeks by Trump’s on-off approach to tariffs. Now Delaware University economist Thomas Bridges says that uncertainty has at least been eased, but he says wider concerns remain: “It’s unclear how that relates to this administration’s economic objectives. And I’m not entirely clear what their economic objectives are. It seems to be just more isolationist. But I think that will end up, you know, yielding a sort of a more constrained economy.”Trump says the tariffs will raise revenue and create jobs in the U.S. But economists widely predict they will raise prices and cast a chill over global growth. Such worries have seen money flow into traditional safe havens. On Thursday gold hit fresh record highs above $3,160 per ounce, while government bonds and the Japanese yen also saw gains.Read More